The Great Valley: Why the Labor Market is Cooling Down

The sand has settled at the bottom of the "Great Reshuffle", leaving everyone wondering, what happens now?

I was listening to this fascinating 1965 interview with Frank Herbert, the author of Dune. Herbert told the unlikely story of how he got the idea for the book: learning about how the U.S. was controlling the flow of sand dunes in Oregon.

“…I got fascinated by sand dunes because I'm always fascinated by the idea of something that is either seen in miniature and then can be expanded to the macrocosm, or which but for the difference in time - in the flow rate, in the entropy rate - is similar to other features which we wouldn't think were similar, like a river.”

At the risk of betraying subtlety, I’d like to compare sand dunes to labor markets: Just as wind patterns shape sand dunes, forces like technological advancements or shifts in consumer demand shape labor markets, causing periods of volatility and equilibrium, peaks and valleys.

Viewed closely, millions of individual moves - people seeking opportunities that align with their skills, preferences, and aspirations - are what forms the labor market. But zooming out, they look more like grains of sand, shaped into contours and patterns that we can examine and interpret to make sense of the larger macro picture.

Cooling labor market: entering the Great Valley

One such pattern was the “great resignation”, more aptly re-termed the “great reshuffling”, where we saw record levels of quitting and job-hopping. The historically tight labor market was driven by second-order effects of Covid-19 like early retirements, excess deaths, supply bottlenecks, demand shocks, and remote work.

Now, most of these factors have partially or fully subsided and we’re starting to see things cool down. Looking at Bureau of Labor Statistics data, separations (turnover) and hire rates are declining below pre-pandemic levels, though job openings remain somewhat elevated - which could be a sign of lingering talent shortages in certain sectors.

Another related trend is domestic migration (the amount of people who move within the country), which has also slowed down from pandemic-era highs.

However, it’s crucial to consider these trends in the context of a relatively strong labor market that continues to boast strong job growth and low unemployment. Based on that context, not to mention the stubbornly high level of openings, we would certainly expect a higher rate of movement / quits than we’re seeing.

Many are calling this “the big stay”, but I don’t like this term for the same reason I didn’t like the “great resignation” - it fails to adequately describe the dynamics underlying the trend. Again, labor markets are like sand dunes. What’s happening is the aftermath of a big reshuffling, the trough of a wave. It might be better characterized as a “great valley”.

The consequences of thick labor markets

One explanation offered by Gad Levanon, Chief Economist at The Burning Glass Institute (a labor analytics research firm), is that the great reshuffling essentially sorted a large number of people into jobs that are better fits for them than what they had before:

“When employees find jobs that better meet their needs and expectations, they are more likely to stay put, reducing the turnover rate.”

I tend to agree with this interpretation but I come at it from a slightly different angle, which is that of labor market density. Some quick definitions:

Thin markets are markets with a lower amount of buyers and sellers - creating conditions where it can be difficult to find good matches

Thick markets are markets with a higher amount of buyers and sellers - making it easier to find an ideal match

Remote work was a substantial shift circa 2020 that removed geographic barriers in labor markets for some jobs, creating a profound increase in labor market thickness. Any recruiter will have witnessed this over the past several years, with “remote” job postings receiving a much larger number of applicants. The sudden shift to thicker labor markets certainly could have been a contributor to the great reshuffle: with new opportunities to seek better matches, people switched jobs a lot in the short run.

That being said, thick labor markets can have some pretty counter-intuitive effects in the long run. A study published in 2012 looked at the relationship between labor market thickness and worker turnover across U.S. cities and found that because thick labor markets give people so many options, workers in these markets eventually “sort” themselves and find the best possible fits, culminating in less job switching overall.

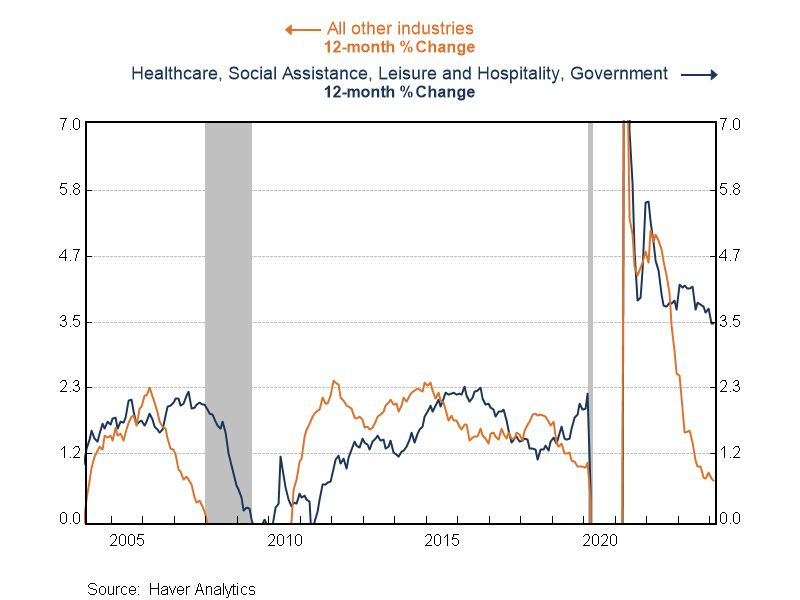

This could explain why we’re seeing a stark divergence in the labor market, one that Gad pointed out in a recent LinkedIn post. The chart below looks at the job growth rate, split by industry. Healthcare, social work, and hospitality (retail) - sectors where remote work is less common by nature - are cooling down at a much slower rate than all other industries.

Hindsight is 20/20 and there could be other explanations, but this is exactly what we would expect from thinner, geographically-bound labor markets where finding better matches is more difficult.

The Great Valley: what now?

If better person-job matches are indeed a big reason for the labor market cooldown, that would be great news for the larger economy, and could even improve overall economic productivity.

Within HR / people operations, a lower rate of quits for the foreseeable future creates a different dynamic. Recruiting teams may be less under-water, and organizations may enjoy lower costs associated with turnover. On the other hand, leaders might worry that exceptionally low rates of turnover could be a bad thing, presenting fewer opportunities to “manage out” low performers or bring in new employees with needed skills.

In this environment, it could be advantageous to spend resources on the assessment and development of talent, and to spend some time figuring out who you really want to retain long term. After all, labor markets move in waves, and we won’t stay in the Great Valley forever.